How ILPs and Endowments Can Serve Different Financial Needs

Besides providing protection, insurance policies can also help to save and grow wealth. Two common insurance products in the market are investment linked policies (ILPs) and endowment plans. These products are typically used for investment and wealth accumulation. To many, they may look like they both serve the same purpose of helping you save or grow wealth, but what are their actual differences, and how should you choose between the two?

How are ILPs and endowment plans different?

The biggest difference is the way that the premiums you pay are used. ILPs invest your money in your chosen sub-funds (hence the term “investment-linked”), for which you receive non-guaranteed returns. This means the performance of the ILP is affected by how well its various sub-funds perform. As a reward for this added risk, the returns from an ILP are potentially higher if the sub-funds perform well.

With endowment plans, the premiums go into the insurer’s participating fund. In general, endowment plans have some form guaranteed returns, and they are less volatile and less risky, which makes them suitable for those with a conservative risk appetite (e.g. if you have just a guaranteed return, then this is all you will get; even if economic conditions are good and other products are doing better).

ILPs and Endowment plans both typically provide a pay-out upon death; many also provide coverage for terminal illness, or Total Permanent Disability* (TPD).

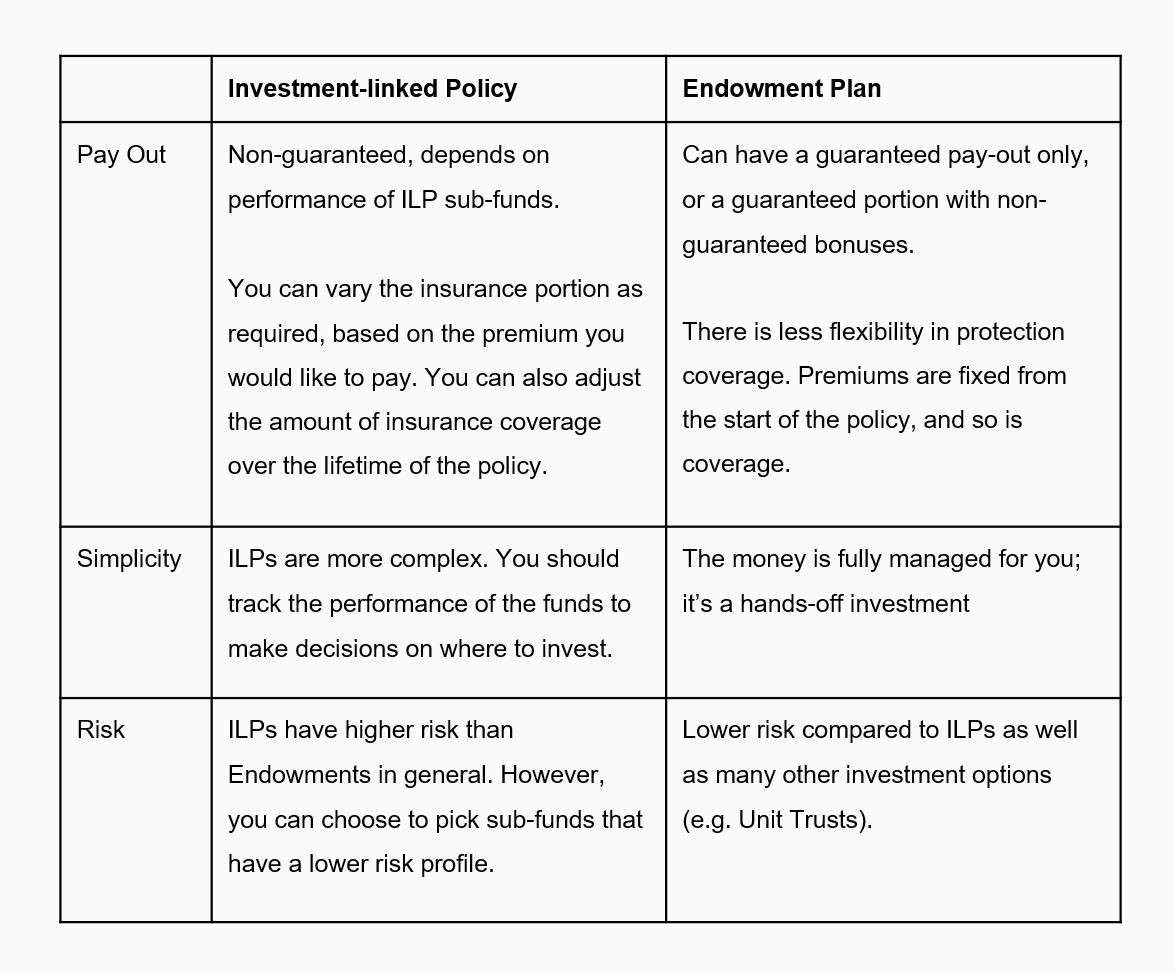

The table below shows some of the differences between the two plans:

Here are how the two can fit different financial situations:

- Variable versus fixed payouts

If you already have a portfolio of mostly low risk assets, such as vanilla bonds or Singapore Savings Bonds (SSBs), then ILPs provide a way to round-out your portfolio. ILPs can provide higher returns if the sub-funds perform well, thus making up for the lower returns of your low risk assets.

Conversely, if your portfolio already has higher risk assets (e.g. it is purely composed of equities), then you can consider lowering your risks by adding assets such as endowment funds. This will ensure that part of your wealth is preserved and continues to grow, even during economic downturns.

- Specific financial goals versus building your retirement fund

Endowment plans can be good for specific financial goals, as the returns provide relatively more stable returns than ILPs. For example, you may have a very good gauge of how much you need to make the down payment on your first home, or to pay for your child’s university fees.

An endowment plan can have varying durations – you can pick a duration that matches your financial goals (e.g. make the down payment on your first home in 15 years, if you’re 20). This ensures you will have enough funds at the right time.

For growing your wealth in general, however, an ILP might have the potential to provide better returns; especially over a long-term period. This is because the performance of various funds tend to smooth out over a longer investment horizon.

ILPs also provide flexibility. For example, in times when you’re cash strapped, you can take a premium holiday and use units in your funds to keep paying for protection. Some endowment products do have withdrawable bonuses that might serve the same purpose however; so speak to a financial consultant on the best options.

- Varying capacity for risk

ILPs generally have higher risks. Younger investors, who have a longer investment horizon, may have a higher risk appetite and prefer ILPs. Wealth growth is often a priority for younger investors, who face greater inflation rate risk (i.e. the rising cost of goods over time, which may significantly diminish their retirement funds if they can’t keep pace).

On the other hand, older investors may want to emphasise wealth protection over growth. This may mean fewer volatile investments as they near retirement (older investors have less time to replenish any investment losses). Endowment plans can thus provide a low-risk, stable complement to their savings.

Besides age, many other factors influence the degree of risk you should accept – these range from your number of dependents, to income level, to the nature of your career. Speak to a financial consultant, who can conduct a proper risk assessment for you and recommend the right products.

- Differing levels of financial literacy and interest

ILPs provide a more hands-on alternative, to those who have higher levels of financial literacy, or who want a more in-depth knowledge of their portfolio. They typically contain many sub-funds that are invested in different regions, commodities, sectors, etc. You have the ability to choose which funds to invest in, after studying their performance.

In terms of financial protection, you also have the means to adjust your level of insurance coverage, as your lifestyle and health change.

However, some investors prefer to be hands-off, or don’t feel they have the financial know-how to manage such details. An endowment plan allows them to entrust everything to the insurer’s full-time financial professionals, for peace of mind.

- Protection versus savings

Most endowment plans provide only basic forms of coverage; some investors may require more comprehensive life insurance to fully provide for their protection. This can result in having to buy both life insurance policies and endowments.

ILPs, however, are a hybrid of protection and investment. You can vary the amount of coverage as you require. As such, it can be a “one stop shop” for both protection and investment.

It’s not about “which is better”, but “which is better for you”.

Ultimately, you should always choose your insurance plans based on your individual financial situation and needs. Avoid “one size fits all” arguments, such as sayings that one product is “always” better than the other.

It’s best to get a qualified financial consultant to work out your financial needs first, so they can advise you on which product suits you best.

Disclaimer:

This article is for general information only and does not take into account the specific investment objectives, financial situation or needs of any particular person. The views expressed herein do not necessarily reflect the views of AXA Insurance Pte Ltd and should not be construed as the provision of advice or making of any recommendation. There is no intention to distribute, or offer to sell, or solicit any offer to purchase any product. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided.

| >> STAY UPDATED WITH OUR LATEST PROMOS, EVENTS AND FINANCIAL ADVICE. CLICK HERE TO SUBSCRIBE. << |

|

|

| Disclaimer | Privacy | Terms And Conditions All rights reserved. © Alliance Organization 2024 |

|