What Riders Can You Consider For Your Term Life Insurance?

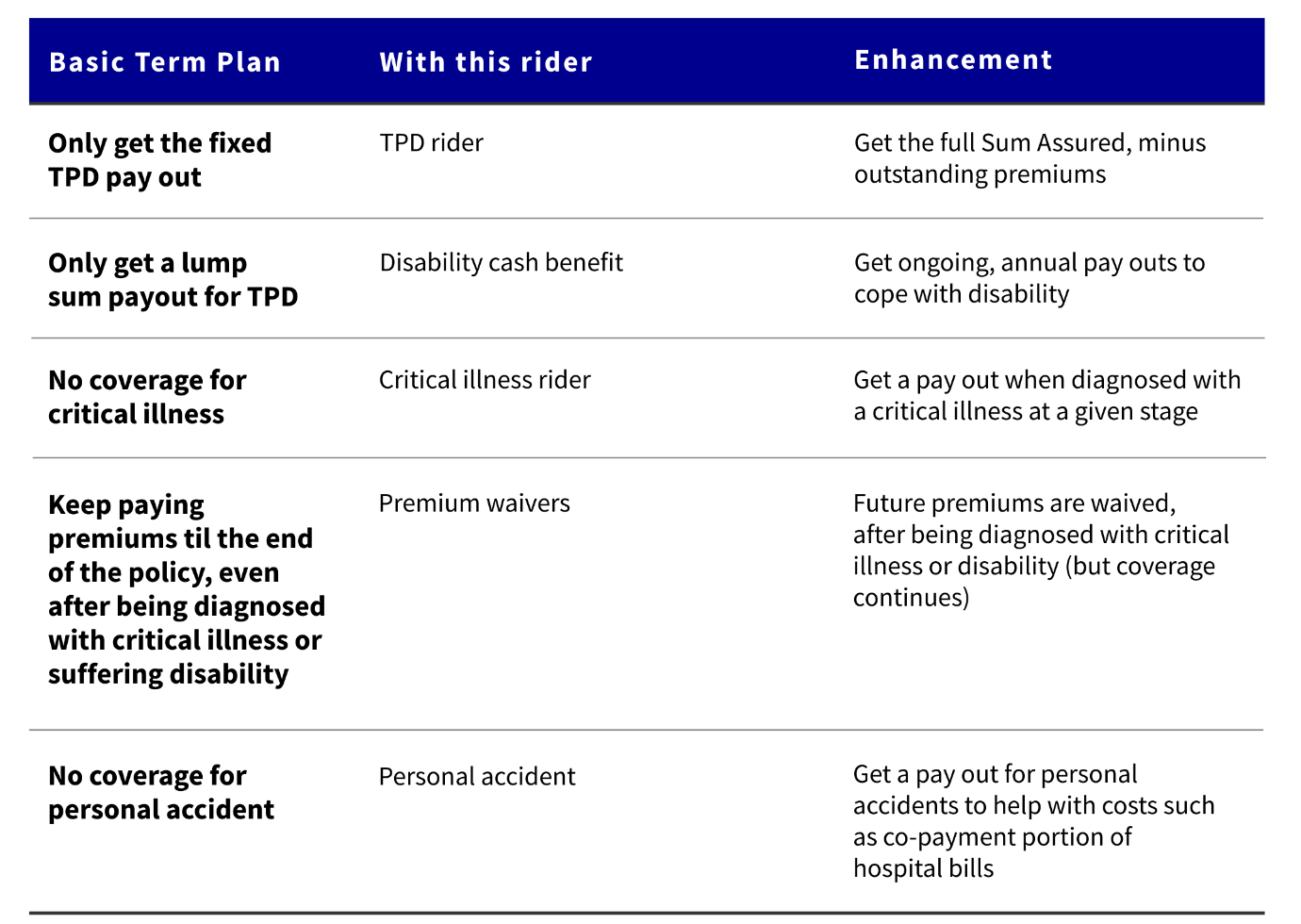

Not all term life insurance plans offer the same degree of protection; you can customise your term plan to make it better.

Term life insurance is a simple and cost-effective form of financial protection. A basic term life plan provides a fixed pay out (called the Sum Assured, or SA) to your beneficiaries upon death, and upon diagnosis of a terminal illness.

Besides this basic coverage, term life plans are also customisable. For small incremental costs to premiums, you can expand the coverage of your term life plan by adding riders.

Here’s a rundown on the types of riders you can consider adding:

- Get a Total and Permanent Disability (TPD) rider to cover unexpected costs arising from disabilities

Disabilities can result in many unexpected costs; an advance TPD pay out ensures flexibility, and that the cash will be there when you need it

As mentioned above, a basic term plan provides a pay out upon diagnosis of a terminal illness, and upon death. However, the pay outs for your family – or your remaining time – may not be sufficient.

For example, say you have total blindness and it results in a need for constant care. You may need to hire a domestic helper or other live-in assistants to help you in your day-to-day tasks.

You also need to consider your family’s financial situation. If your children are still young, for instance, the pay out must provide for them, and your other dependents, till they’re old enough to look after themselves (e.g. till the age of 18 or 21).

Term insurance plans like AXA Term Protector allow you to add an Advance TPD rider. This means that if you suffer TPD before you’re 70 years old, you can get an immediate pay out of your sum assured (minus any outstanding premiums). This quicker, more upfront payment helps to cope with the many unexpected costs that can come from disability.

- Get disability cash benefits to supplement lower income

Disability may impact your ability to work (even if it’s not Total Permanent Disability). For example, losing your mobility could mean you’re no longer able to work a previous job in construction. This can mean having to switch to a different job, which may pay less.

You can add a disability cash rider to your term insurance, to make up for this. This will provide annual pay outs, instead of just a single, lump sum payout. This helps to supplement your income, and maintain your quality of life as best possible.

- Have the funds to stop working and focus on recovery, if you suffer a Critical Illness

A basic term plan just covers death or terminal illness. But with a Critical Illness rider, you’ll also have the cash to focus on recovery, or spend time with family.

Critical Illness refers to conditions such as stroke, coma, and major cancers – the insurance industry in Singapore generally recognises 37 conditions as Critical Illnesses; but you should check what exactly is covered with your insurer.

A term insurance plan usually does not cover Critical Illness; only death and terminal illness. But you may be able to add a critical illness rider to your AXA Term Protector that also extends coverage for critical illnesses.

This gives you the funds to stop working right away and focus on recovery, or spending your remaining time with family. Under a basic term insurance plan, your beneficiaries would only get the pay out after your death.

- Get premium waivers to help with the costs of your policy, when the worst happens

With a premium waiver, you can continue to be protected without having to pay future premiums, when you suffer TPD or a Critical Illness

Some riders offer the chance for a premium waiver. These can remove the need for future premiums, when you suffer conditions like TPD or a Critical Illness.

For example, a critical illness premium waiver will waive all your future premiums when you’re diagnosed with Critical Illness (you will still get the pay out upon death, without having to pay any more premiums.)

There is also a rider available in the event of TPD or Critical Illness diagnosis, or the death of the person paying for the plan – all future premiums can be waived. For example: if you buy the term plan for your child, and you pass away, your child will still be protected by the term plan, without needing any future premium payments.

- Cover the cost of Personal Accidents, which can happen anywhere

Basic term insurance doesn’t cover Personal Accidents. If you get into any accidents, none of these will be covered by your term plan.

If you add a Personal Accident rider however, you can get a pay out for these various accidents. This can help you cover the co-payment portion of your hospitalisation plans, make up for a few lost days of income (e.g. if you’re self-employed) or cover the cost of any additional treatment outside the hospital.

Term plans are more flexible than you think

A term plan can be customised to your specific needs, such as by including a Critical Illness rider, if you lack other financial protection in this area.

Disclaimer:

This article is for general information only and does not take into account the specific investment objectives, financial situation or needs of any particular person. The views expressed herein do not necessarily reflect the views of AXA Insurance Pte Ltd and should not be construed as the provision of advice or making of any recommendation. There is no intention to distribute, or offer to sell, or solicit any offer to purchase any product. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided.

| >> STAY UPDATED WITH OUR LATEST PROMOS, EVENTS AND FINANCIAL ADVICE. CLICK HERE TO SUBSCRIBE. << |

|

|

| Disclaimer | Privacy | Terms And Conditions All rights reserved. © Alliance Organization 2024 |

|