How to Choose Between Participating and Non-Participating Whole Life Policies

Whole life insurance policies can provide financial protection up to the age of 99, long after you’re done paying for it.

Life insurance has come a long way – these days, life insurance policies offer greater flexibility in how they accumulate value, and how they can fit into different financial plans. One example of this is the choice of Participating (Par), and Non-Participating (Non-Par) whole life insurance.

First, what is a Whole Life Policy?

For the difference between Par and Non-Par policies to make sense, we must first understand the principles of how a whole life insurance policy works.

Whole life insurance typically provides a pay out upon death, Total Permanent Disability (TPD), or Terminal Illness (TI).

With whole life insurance, you are covered for life (usually up to the age of 99). This is somewhat different from term insurance, in which you choose a set period for the policy.

With whole life insurance, you can vary the premiums to suit your financial situation. For example, you could have a policy in which you pay higher premiums for 15 years, but are then covered till the end of your life; or you could have a policy where you pay lower premiums, but for a period of 20 or more years. This allows you pick a plan that won’t get in the way of your cashflow.

Vary your premium payments based on your needs. It’s possible to get 99 years of protection with just 15 years of premium payments.

If at any point you feel you don’t need the life insurance anymore – such as if your children are capable of looking after themselves – you can opt to surrender the policy. This will give you a pay out known as the surrender value.

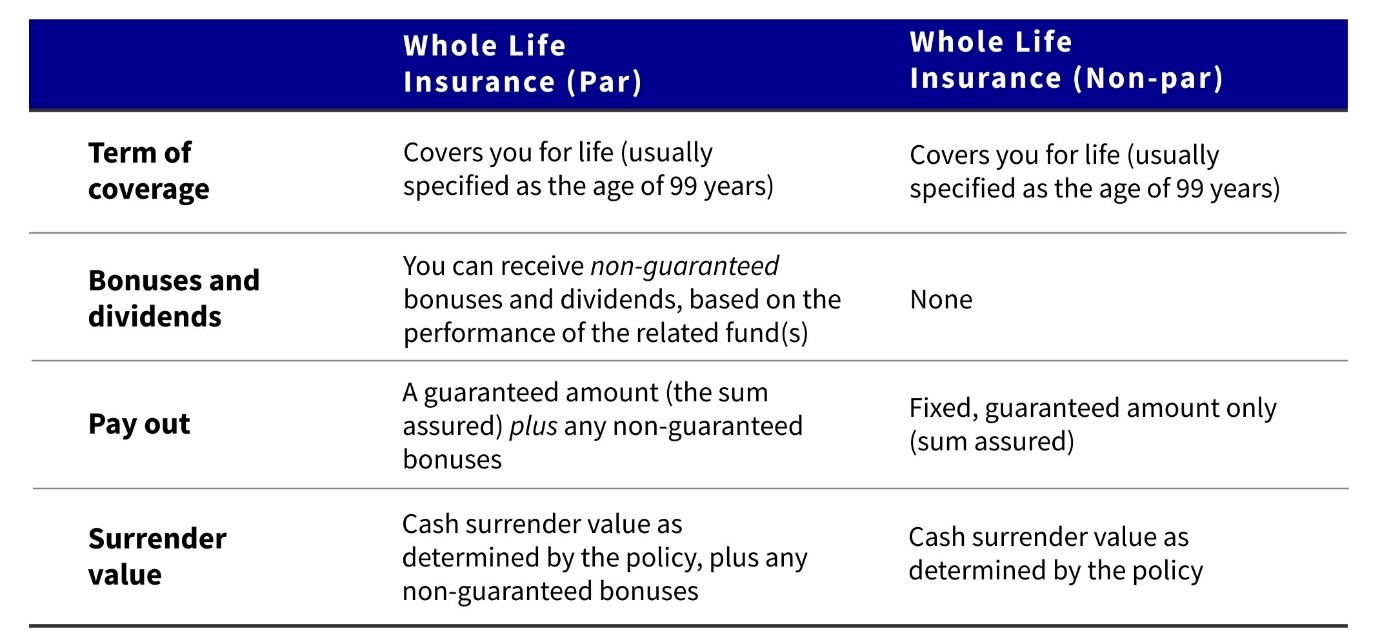

Term versus Par versus Non-Par Policies

However, par and non-par policies differ in pay out and surrender value

Both par and non-par policies have a guaranteed pay out, called the sum assured. However, par policies have an additional, non-guaranteed portion, which can be added to the sum assured.

When a claim is made for a par policy, or when you surrender the policy, your pay out will consist of both a fixed, guaranteed amount, plus a variable bonus (called the non-guaranteed bonus).

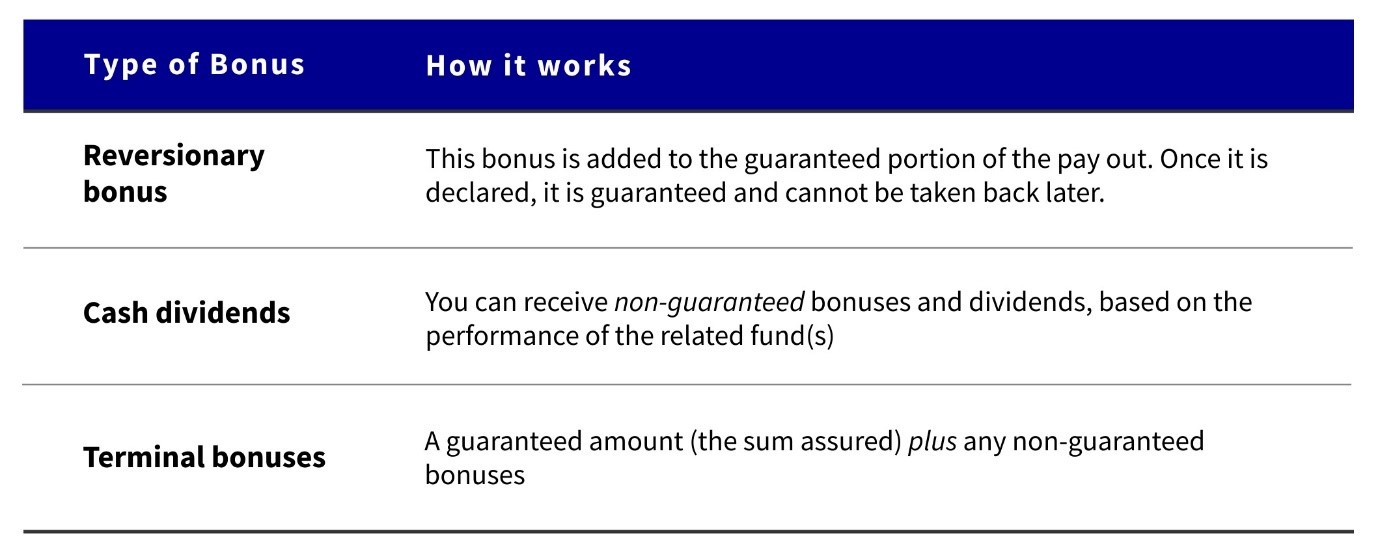

There are three types of non-guaranteed bonuses:

In good market conditions, the pay outs from a par policy have the potential to be much higher than those of a non-par policy. This is your premiums for a par policy are also invested by the insurer, in various approved assets such as equities, bonds, etc. If these investments perform well, you might see high non-guaranteed bonuses. This can result in pay outs that are significantly higher than the sum assured. This is because a Par policy pay out is the sum assured, plus any non-guaranteed bonuses (a non-Par policy only pays out the sum assured).

Besides this, some policies – such as AXA Life Treasure – have a multiplier benefit. You can guarantee anywhere from two to seven times the sum assured, until you are 70 years old.

How do you decide which policy to choose?

No whole life plan is right for everybody – balance the premiums that are affordable for you, with your financial needs.

There is no fixed answer on which policy is “better”, as it’s up to your individual situation. The main concern should be your budget – avoid choosing a plan with premiums that are too high, as financial emergencies can result in difficulties maintaining it. At the same time, you should not skimp on the coverage you need, just to save a little bit on premiums.

In determining appropriate coverage, you should take note of critical needs such as:

- Dependents with special needs, or who for some reason cannot work

- Whether you are the only child, providing for aging parents who cannot keep working for long

- If you have business or personal debts, and want to guarantee they’re paid off if you pass on or become disabled (to prevent your family inheriting the debt)

- Whether there’s a targeted goal with a fixed amount, for your loved ones (e.g. you have a fixed plan for your spouse to fly home and be able to afford a house in another country, if you pass on).

Speak to a Financial Consultant, on estimating the right amount of coverage for such factors; they’ll also be able to advice you on whether a par or non-par policy best suits your situation.

What if you decide you don’t need the policy, much later in life?

You may find, much later in life, that you don’t need the policy as much as you needed it before.

For example, consider if – at the age of 65 – your children are affluent, own their own property, and are high-income earners. They don’t need a big inheritance if you pass on.

You may then decide to surrender your whole life policy, and instead use the surrender value for a more pleasant retirement.

Don’t neglect the possibility that – whatever your family’s situation may be at present – a lot can change with the passing of decades.

Disclaimer:

This article is for general information only and does not take into account the specific investment objectives, financial situation or needs of any particular person. The views expressed herein do not necessarily reflect the views of AXA Insurance Pte Ltd and should not be construed as the provision of advice or making of any recommendation. There is no intention to distribute, or offer to sell, or solicit any offer to purchase any product. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided.

| >> STAY UPDATED WITH OUR LATEST PROMOS, EVENTS AND FINANCIAL ADVICE. CLICK HERE TO SUBSCRIBE. << |

|

|

| Disclaimer | Privacy | Terms And Conditions All rights reserved. © Alliance Organization 2024 |

|