5 Things You Should Know About Life Insurance and Why You Should Get It

What is Life Insurance?

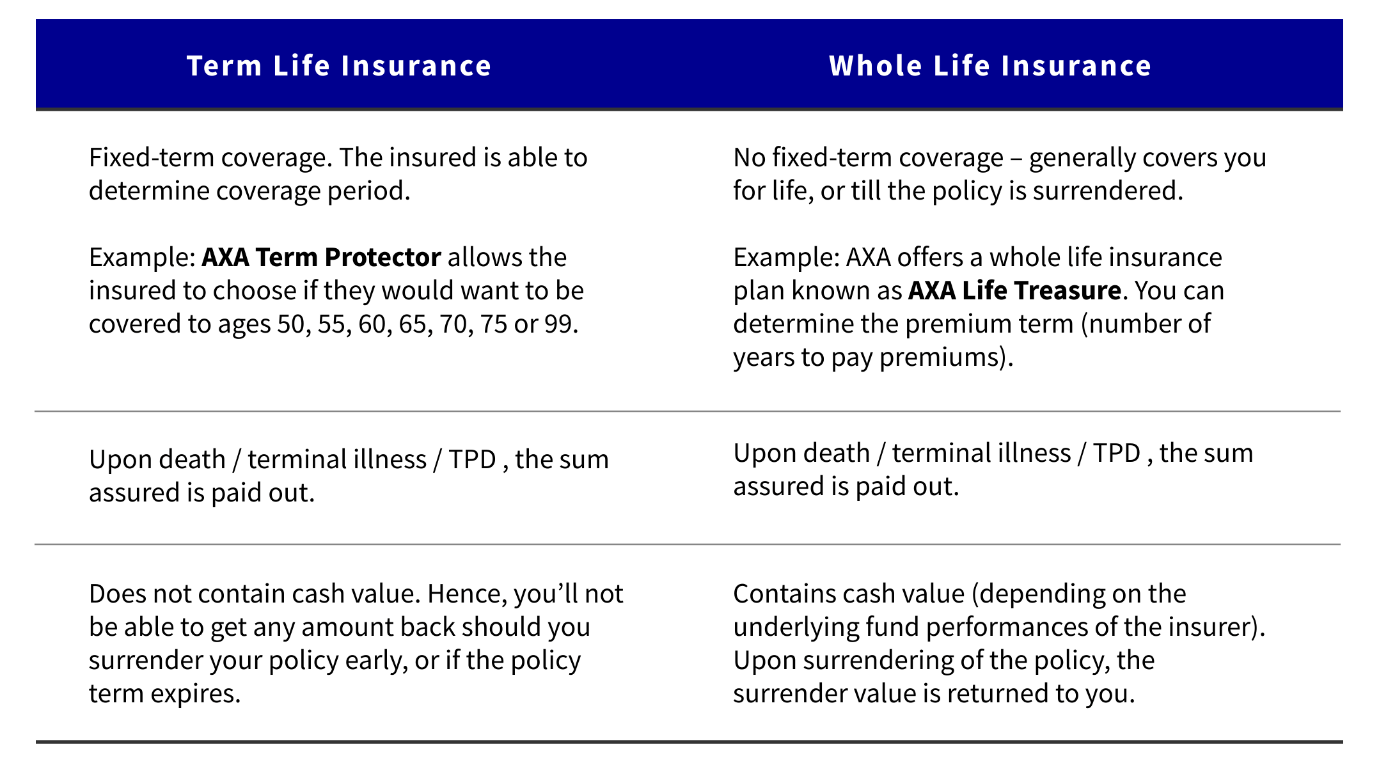

Life Insurance is a type of insurance that provides the insured or their dependents with a pay-out in the event of unexpected circumstances such as death, terminal illness or total and permanent disability (TPD). There are two common types of life insurance – term and whole life insurance.

Regardless of the type of life insurance, it can be an important part of your financial planning. In this article, we discuss some important aspects of life insurance and why you should consider having some form of protection in place.

- Leaving something for your loved ones

One thing that most Singaporeans can leave behind for their loved ones is a sum of money to cushion the rest of the financial burden their family may face in the future. This sum of money is important, especially in the event of an unexpected death or illness. Such unexpected life events may leave the family financially defenceless, especially for families with high financial commitments (e.g. loans, car payments, school fees).

That is why life insurance can help us to better prepare. Having a life insurance plan can give the insured a peace of mind when such unfortunate events occur.

- You can plan your cash flow with your preferred coverage term

Most life insurance plans offer a wide variety of payment options, such as allowing you to choose premium payment terms of 10, 15, 20, 25 or 30 years.

In addition, customers can also choose if they would like to pay their premiums monthly, quarterly, half-yearly, or annually. The purpose of having many possible payment options is so that they can suit different individual’s financial circumstances.

Should you want to increase your coverage, there is also an option to do so. Most life insurance plans offer such flexible options to cater to people with different financial needs and preferences.

- You can customise your insurance plan according to your needs

As life expectancy increases and the rate of chronic illnesses are growing, getting yourself protected against critical illnesses is of increasing importance. Yet according to a 2017 Protection Gap Study done by Life Insurance Association Singapore (LIA), Singaporeans have a mortality protection gap of 20% and a critical illness protection gap of 80%.

Most life insurance plans cover death, Total and Permanent Disability as well as Terminal Illness. On top of this basic coverage, life insurance plans also usually come with a variety of riders, which are add-ons that you can purchase on top of the basic whole life insurance plan for an added layer of protection. For instance, many life insurance plans offer critical illness riders. The insurance industry in Singapore generally recognises 37 conditions as critical illnesses; but you should check what the specific policy you’re considering covers.

- Every penny is worth it knowing that you are well protected.

It is a well-known fact that whole life insurance premiums tend to be more expensive than term life insurance premiums. Part of the reason why this is so is because of the cash value that whole life insurance offers. Should you surrender your whole life insurance policy before the coverage period is up, you will be able to get back some cash value. Some policies also allow you to take a loan from the cash value inside your whole life insurance plan as well.

Furthermore, life insurance is more affordable when you get it while you are still young and healthy. Premium price increases with age, as well as with the diagnosis of medical conditions.

Life insurance is also a form of protection for you and your loved ones. By paying a premium for 15 to 30 years, you are covered for the rest of your life. The peace of mind that comes with knowing that you are well protected makes it worthwhile for many.

- You should consider buying life insurance while you are still young

Life insurance premiums tend to be cheaper while you are younger. This is because you are further away from the expected life expectancy and are less likely to fall sick. Premiums are also lower when you do not have any pre-existing medical conditions – if you postpone buying insurance until you get older, there is always a risk that you could already have a medical condition as the years go by. Typically, these conditions are taken into account when buying insurance, and may increase the premiums or prevent you from being insured.

Wondering what policy you should get?

If you are unsure as to about the type of life insurance you should purchase now, or what coverage term should you be getting, reach out to your financial consultant today to find out which products suits you the best.

Alternatively, you can also make use of by Life Insurance Association to get an immediate estimate of how much you should be covered for based on your financial goals and needs.

Disclaimer:

This article is for general information only and does not take into account the specific investment objectives, financial situation or needs of any particular person. The views expressed herein do not necessarily reflect the views of AXA Insurance Pte Ltd and should not be construed as the provision of advice or making of any recommendation. There is no intention to distribute, or offer to sell, or solicit any offer to purchase any product. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided.

| >> STAY UPDATED WITH OUR LATEST PROMOS, EVENTS AND FINANCIAL ADVICE. CLICK HERE TO SUBSCRIBE. << |

|

|

| Disclaimer | Privacy | Terms And Conditions All rights reserved. © Alliance Organization 2024 |

|