Putting a Legacy Plan in Place, so Your Family Won’t Have to Do It for You

Thinking about your passing may be disconcerting and even morbid for many. However, when you do so, you will be in a position to leave well – enabling you to give your loved ones the emotional and financial support they need when you are no longer around.

This is important because it protects their standard of living, such as paying for expenses until your children are able to support themselves financially, providing adequate resources for your spouse to continue caring for the children while building up their own retirement funds, or safeguarding your parents’ golden years.

It can also be to leave behind a legacy you want to be remembered by, which not only includes your money and assets, but also personal belongings, memories of you and principles you abided by.

Conversely, if you do not put a legacy plan in place, you may expose your family, who are still dependent on you, to a scenario where they may struggle to cope with their daily living expenses, or be unable to afford important expenses you may want to provide for them, such as a university education for your children or a comfortable retirement for your elderly parents.

Moreover, family members may be put in a position where they have to work to decide how to split your assets, and figure out the best way to manage your possessions.

To avoid this, here are some simple things you can do.

- Determine what your loved ones will need

When thinking of a legacy to leave behind, you should try to understand the financial safety net your loved ones will need to get by without you. According to the Life Insurance Association of Singapore (LIA), the average person in Singapore needs 9.0x their annual income to pay for essential expenses for their loved ones in the event they pass on. These include:

- funeral costs;

- unpaid services such as part-time helper to cover their household duties;

- their share of personal and housing loans;

- their share of future household expenses;

- Dependents' daily expenses; and

- their share of children’s school fees

You need to calculate these figures for yourself to find out how much you need and wish to leave behind to your loved ones. You then need to cover any potential insurance gap, which is the difference between your current assets plus life insurance coverage, and how much you need to leave behind for your family in the event of your absence. This can be an uncomfortable task, but it’s important.

You can use a term life insurance policy to plug the gaps. These plans allow flexibility in coverage (e.g. choosing coverage between 5 to 30 years), allowing the protection to lapse once you do not need it – such as when your children are expected to financially provide for themselves or your parents are no longer around.

- Understand Singapore’s Intestacy Laws

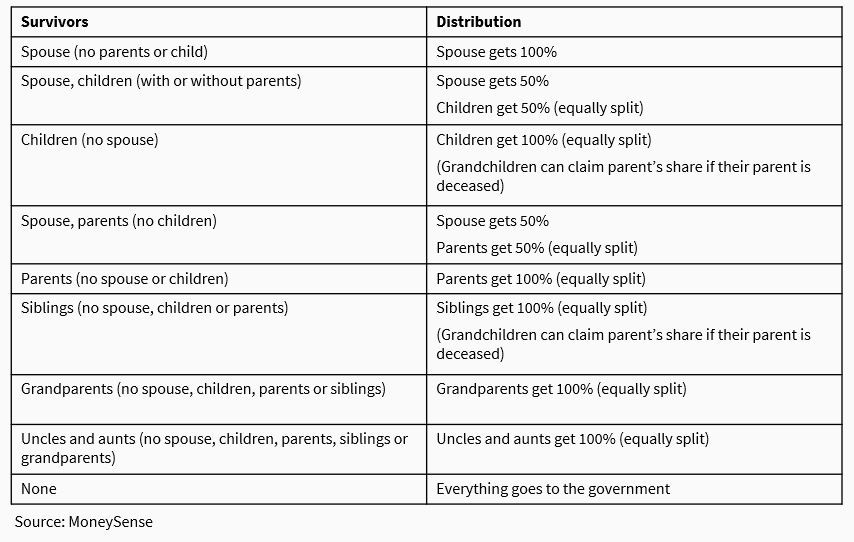

If you pass on in Singapore without a will, your assets will be distributed according to the Intestate Succession Act. According to the act, here is how your assets will be distributed:

If you are happy with this arrangement, you may choose not to write a will. However, there may be uncertainties over guardianship of children. If so, the guardian, including an ex-spouse, may gain access to your assets.

It may also take longer to distribute assets as the probate process can be complicated and may also cost money. Your assets may also be distributed against your wishes, as you may have told your parents or another dependent that you intend to leave them with financial security, only for them to realise that without a valid will, the court will follow the Intestate Succession Act.

You should also note that the Intestate Succession Act does not apply to Muslims. Instead, when Muslims pass on, their beneficiaries must apply to the Syariah Court for an Inheritance Certificate.

- Get your paperwork in order

There are several things you can do on the administrative front, such as creating a will. Apart from removing uncertainties over the way you want your assets to be distributed, it also makes it easier for your beneficiaries to access to your assets.

You can also leave behind assets to protect other dependents you have, or give away part of your assets to an organisation or charity.

Your will does not cover your CPF monies, which do not form part of your estate. This is why you need to make a CPF Nomination, which can also be done online since January 2020, for the distribution of your CPF monies.

You should consider creating a lasting power of attorney (LPA) to appoint trusted aides to act on your behalf, in the areas of your personal welfare and your property and affairs, should you lose the mental capacity to do so. If you do not have an LPA, there will be uncertainties over who should be the one caring for you and managing your financial assets.

Another thing you can consider is having an Advanced Medical Directive (AMD) to inform doctors treating you if you become terminally ill and unconscious, and do not wish for any extraordinary life-sustaining treatments to be used.

- Leave behind good memories

Your assets are not the only valuable things you leave behind. Spending quality time with your family and leaving positive memories is also important. You may also leave behind other important personal belongings and heirlooms to your family members who will treasure them.

When you go, you may not be physically present to guide your loved ones. However, by constantly imparting your values and living your life in a principled manner, you can leave a lasting impression to guide the next generation.

Putting your legacy plans in place is not the end of it – You need to tell your loved ones

Discussions around the topic of death, inheritance and money are often frowned upon as taboo, especially in Asian society. However, by speaking to your loved ones and letting them know the plans you have set in place, you can prepare them for a future where you may not be around to care for them.

This will help them use the funds for the purposes you want and to implement the financial safety net you intended for them.

Apart from this, telling them what assets you own, including properties and their liabilities, investments, insurance policies, bank accounts can be important to help them access the funds quickly and seamlessly.

You should also consider keeping a document for important personal information, account and policy numbers and a schedule of assets that you own. This list will be a practical way to let your loved ones know what are the assets and important documents that they need to have, during a period that is already overwhelming for them.

Disclaimer:

This article is for general information only and does not take into account the specific investment objectives, financial situation or needs of any particular person. The views expressed herein do not necessarily reflect the views of AXA Insurance Pte Ltd and should not be construed as the provision of advice or making of any recommendation. There is no intention to distribute, or offer to sell, or solicit any offer to purchase any product. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided.

| >> STAY UPDATED WITH OUR LATEST PROMOS, EVENTS AND FINANCIAL ADVICE. CLICK HERE TO SUBSCRIBE. << |

|

|

| Disclaimer | Privacy | Terms And Conditions All rights reserved. © Alliance Organization 2024 |

|